RBI to ensure adequate liquidity in system; cuts reverse repo rate by 25 bps

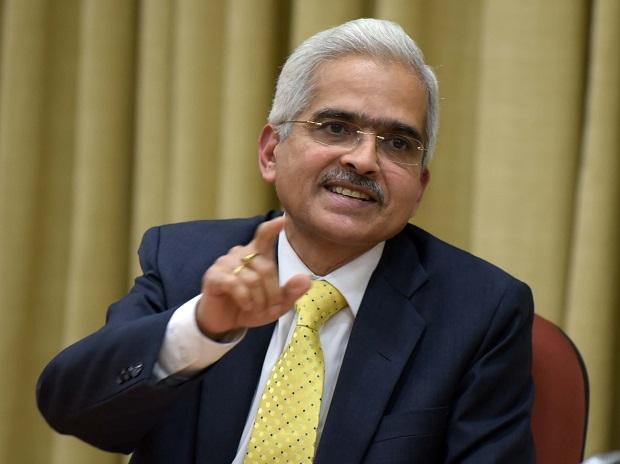

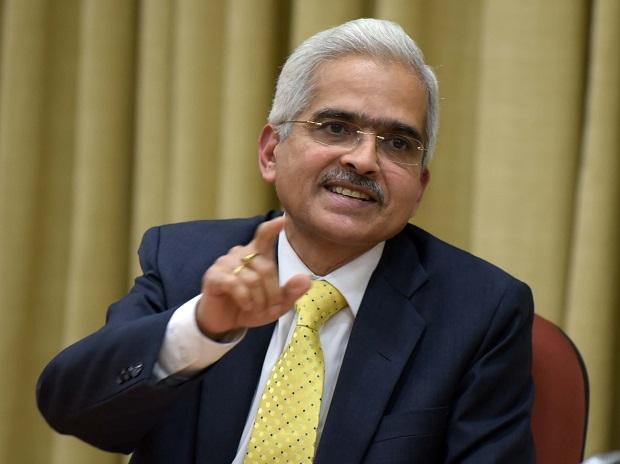

Mumbai, Apr 17 The Reserve Bank of India Governor Shaktikanta Das on Friday said the central bank will ensure adequate liquidity in the system to ease the financial stress caused by the Covid-19 pandemic.

The central bank reduced the reverse repo rate – the rate at which banks park their fund with the central bank – by 25 basis points to 3.75 per cent.

This will encourage banks to lend to the productive sectors of the economy.

With regard to other measures, Das said RBI will begin with giving an additional Rs 50,000 crore through targeted long-term repo operation (TLTRO) to be undertaken in tranches.

Besides, he announced a re-financing window of Rs 50,000 crore for financial institutions like Nabard, National Housing Bank and Sidbi.

He further said surplus liquidity in the banking system has increased substantially as result of central bank’s actions.

Stating that the RBI is monitoring the situation developing out of Covid-19 outbreak, he noted that the contraction in exports in March at 34.6 per cent was much more severe than global financial crisis of 2008-09.

The Reserve Bank of India (RBI) announced a host of measures, including injecting Rs 50,000 crore via targeted long-term repo operations, so that banks provide more liquidity, specifically to small and mid-sized non-banking finance companies (NBFCs) and micro-finance institutions.

The RBI also cut the reverse repo rate from 4 per cent to 3.75 per cent, so that banks are nudged to lend more, instead of deploying funds with the central bank.

Measures to tackle Covid-19

These measures are aimed at softening the impact of Covid-19 pandemic on the financial markets, RBI Governor Shaktikanta Das said, adding that the central bank is closely monitoring the developments and is vigilant.

The other measures unveiled by the RBI include providing Rs 50,000 crore refinance to all India financial institutions — Rs 25,000 crore to Nabard, Rs 15,000 crore to SIDBI and Rs 10,000 crore to NHB — and increasing the ways and means advances (WMAs) limit to 60 per cent to allow States the flexibility to borrow and ensure that their borrowings are not bunched up in the early part of this financial year.

More relief

Among the regulatory measures, the RBI has allowed the three-month moratorium period on loans (from March 1, 2020 to May 31, 2020) to be excluded by banks from the counting of days past due (90 days) when it comes to asset classification by banks. However, during this standstill period on asset classification, banks have to make a provision of 10 per cent and the same can be reversed if there is no slippage.

Given the challenges in resolution, the RBI has extended the resolution time period by 90 days.

Emphasising the need to conserve capital during the current challenging times, the Governor said scheduled commercial banks and co-operative banks cannot declare dividend till September-end 2020.

In a bid to provide succour to NBFCs with exposure to the commercial real estate sector, the RBI has aligned the date of commencement of commercial operations with that of commercial banks so that delays in execution of projects in the current environment doesn’t result in the projects becoming non-performing.

Assuring that the RBI will act as and when the need arises, the Governor said with retail inflation expected to go down to about 4 per cent in the second half of FY21, it will open up space for rate action.

‘Banks need to act fast’

Commenting on the RBI announcements, Vydianathan Ramaswamy, Director- Ratings, Brickwork Ratings said, “reduction in LCR limits for banks to 80 per cent from 100 per cent is a good liquidity measure in the current economic situation. However, banks need to act fast in extending credit to India Inc.”

“TLTRO 2.0 is an important step in safeguarding the stability of the non-banks. However, it’s equally important to ensure this additional liquidity is available to a wider spectrum of NBFCs and MFIs and not limited to a few. The refinancing measures through NHB, SIDBI, NABARD, etc is a welcome relief to HFCs and NBFCs. Non-banks with limited incremental funding options were facing increasing risks of default,” he added.

Post navigation

News Desk

Network 7 Media Group is the flagship media of SB Brand Network & is a new age digital media company based in India. In an era where world's biggest personalities & brands are heavily focused on building the image through digital media world,Related Posts

Recent Posts

- 1.4 billion children globally missing out on basic social protection.

- Union Budget 2024 – Top Pointers to Viksit Bharat

- Indian Economy more robust & powerful than other top world economies!

- G20 New Delhi Leaders’ Declaration Reaffirms ‘Gender Equality’ As Fundamental Issue For G-20

- Latvia will host the VI International Economic Forum: The scientific partner of the event is the world “forge” of Nobel laureates