Indian and international investors are optimistic about the prospects for accelerating growth in India, after New Delhi revealed a budget that will slow the pace of fiscal consolidation, while stepping up public spending in infrastructure.In his first full budget since Narendra Modi’s government came to power in May, Arun Jaitley, finance minister, said New Delhi would ease off a previously outlined fiscal road map, which was aiming to reduce the fiscal deficit to 3 per cent of gross domestic product by 2016-17.Instead, New Delhi delayed the target a year, using the leeway to invest billions of dollars into infrastructure. The fiscal deficit target for the next financial year, which starts in April, will be 3.9 per cent of GDP, higher than the anticipated 3.6 per cent. The fiscal deficit is currently 4.1 per cent of India GDP.Arvind Subramanian, chief economic adviser, has argued India’s corporate sector is heavily indebted to finance large-scale investments, and the government must kick-start investment.New Delhi’s capital expenditure is budgeted for a 25 per cent increase next year, including a one-third jump in railway investment, a 127 per cent surge in spending on highways, and five new 4,000 megawatt power projects.“The budget is a fine balancing act between fiscal consolidation and creating enabling conditions for growth and job creation,” wrote Rohini Malkani, Citigroup’s chief India economist.Pranjul Bhandari, HSBC’s chief India economist, called the budget “positive” for growth and the rupee, but warned that “having taken a breather from the ambitious fiscal consolidation step”, New Delhi will be closely monitored on its spending.Some warned that New Delhi may struggle to fulfil its ambitious investment targets, stymied by the same problems of land and environmental clearances that hinder private sector projects. Mr Modi wants to make it easier to acquire land for industry and infrastructure, but his proposed changes are facing resistance.“The key thing is going to be the implementation of the infrastructure budget, which of course is tied in closely with the land law, which is again up in the air,” said Atul Punj, chairman of Punj Lloyd Group, the conglomerate. “The money is not the issue. The ability to utilise the money will be the issue.”

Mr Jaitley said the government was planning to prepare large infrastructure projects, with ready clearances, and auction them to private companies to execute — what it called a “plug-and-play” model.

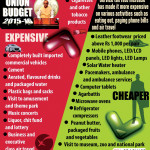

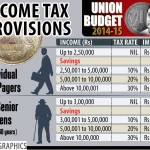

- Union Budget 2015

- Union Budget 2015

- Union Budget 2015

- Union Budget 2015

- Union Budget 2015

On the tax front, Mr Jaitley reaffirmed his determination to implement a nationwide general sales tax system by April 1 2016, replacing the jumble of local fees and taxes that prevent India from being a single market for goods and services. The GST has long been seen as a “game-changer” for business.

Mr Jaitley also revealed what one analyst called a politically brave plan to cut the nominal corporate income tax rate from 30 to 25 per cent over the next four years, while simultaneously reducing exemptions.This year, New Delhi is scrapping a low-yielding 1 per cent “wealth tax” on fixed assets over Rs3m ($48,700), while raising an existing 10 per cent income tax surcharge on India’s “super-rich” — those earning above Rs10m ($160,000) a year — by an additional 2 percentage points, to 12 per cent.Consumers will also be also affected, as service tax is being increased from 12 to 14 per cent, making much of the discretionary spending of the nascent middle class — on such items as dining out, entertainment, and travel — more expensive.

Mr Jaitley promised a host of structural reforms, including greater use of direct benefit transfers to replace subsidies and the creation of a true bankruptcy law. He also pledged a crackdown on “black money” held abroad, threatening jail terms of up to 10 years in prison.India’s stock market, which fluctuated through a special trading period while the budget was revealed, closed up 0.5 per cent. But while the corporate sector gave the budget a thumbs-up, plaudits were not universal, with some warning that it depended on “optimistic” assumptions about both growth and revenues.Manmohan Singh, the former prime minister, called Mr Jaitley a “lucky” finance minister, who had inherited favourable macroeconomic indicators, due to falling global oil prices. But Mr Singh said the government should use the benign external environment to push fiscal consolidation.“Tomorrow, if anything happens with the oil prices, we will have less cushion to deal with this,” Mr Singh told NDTV news. “I therefore worry there is not enough emphasis on fiscal consolidation and macroeconomic stabilisation.”

Eswar Prasad, an economist with Cornell University and the Brookings Institution, also suggested the budget was a missed opportunity to utilise favourable circumstances as “a launching pad for substantive fiscal and other reforms,” especially major subsidy reform.“This budget takes a few small steps rather than a giant leap, and fails to take full advantage of a propitious alignment of stars for the Indian economy,” Mr Prasad said.

[wordpress_social_login]