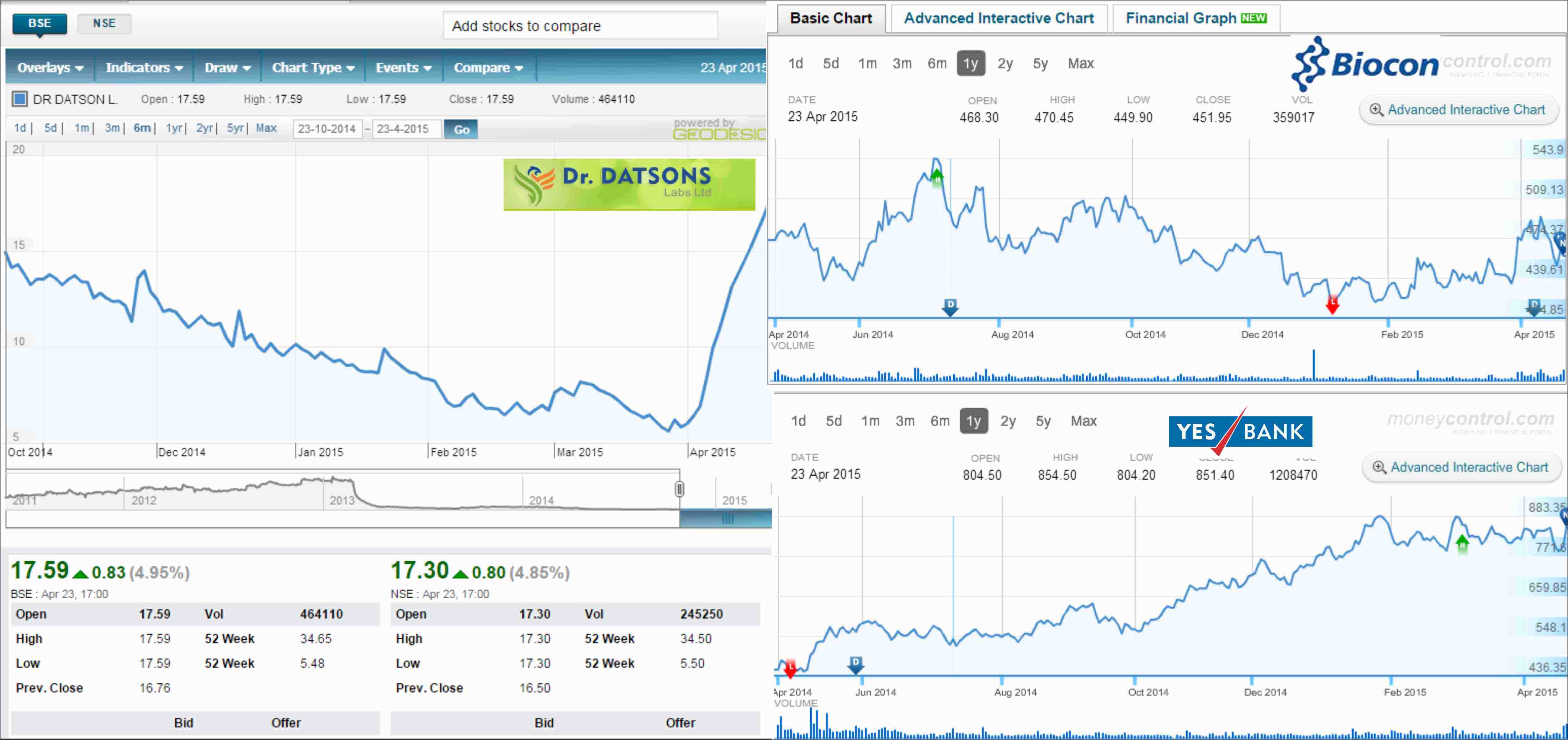

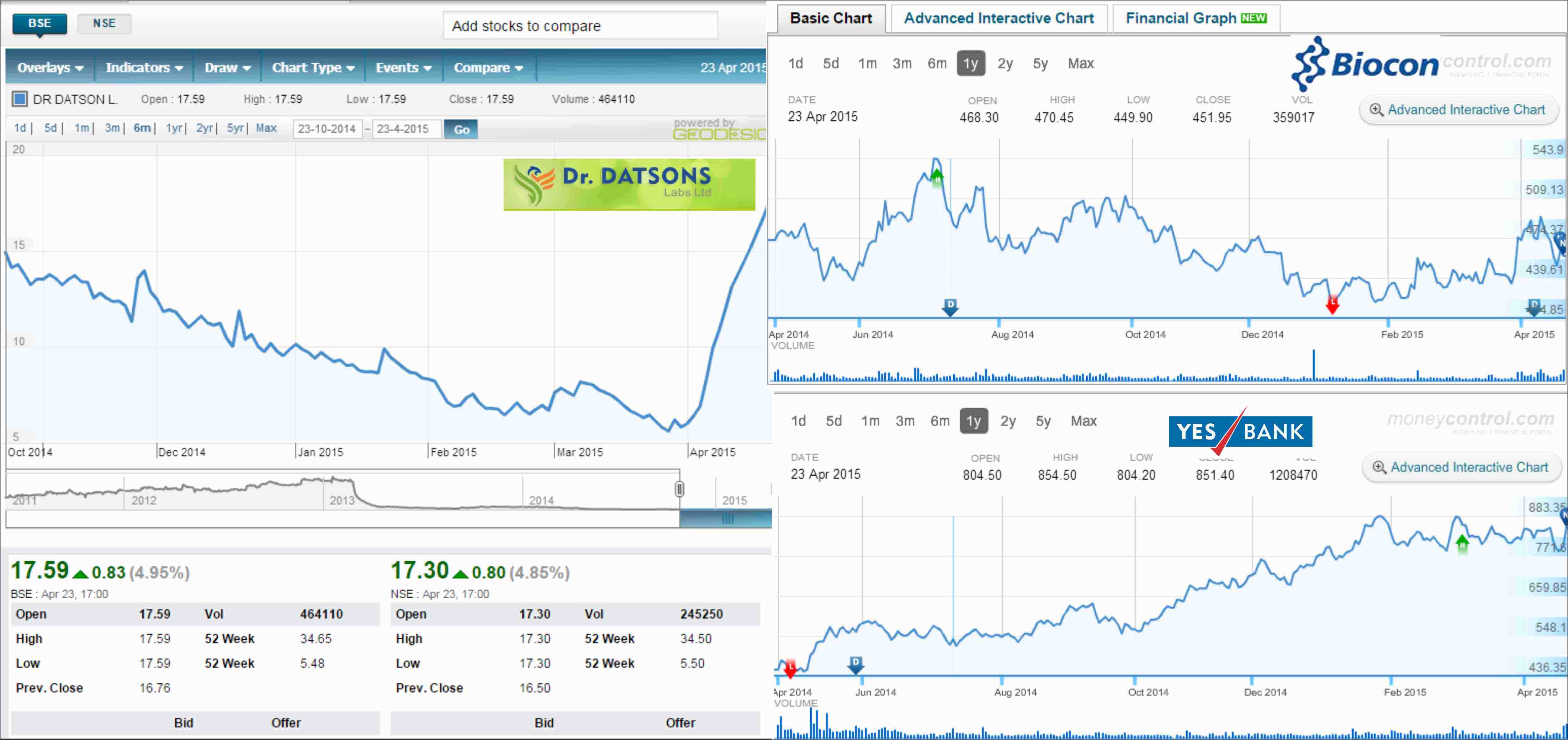

Dr. Datsons Labs gain momentum post strong export order, surges in continuous green!

Dr. Datsons Labs & Biocon outperform despite Sensex drops 189 points to end below 28,000, up 0.83, or 4.95% with volumes of 464,110 shares against the previous day close of 16.76. It is expected to be in the range of 30 in coming days in view of the strong interest in this scrip.

Friday, 24th April 2015, Mumbai, Maharashtra, India. The benchmark Bombay Stock Exchange (BSE) Sensex on Thursday surrendered its early gains to settle lower by 155 points at 27,735.02 as blue-chips took a beating on persisting concerns of foreign investors on tax claims despite governments clarification.The 30-share barometer closed at 7,735.02, 155.11 points or 0.56 per cent lower. Tata Steel gained the most as the shares rose by 5 per cent to close at Rs 368.70 apiece, whereas Sun Pharma emerged as the biggest loser of the day with its shares closing 2.55 per cent lower. On similar lines, National Stock Exchange (NSE) index Nifty closed 31.40 points or 0.37 per cent lower at 8,398.30. The key stocks that made news today were:

Pharma : Dr. Datsos Labs Ltd.

The Mumbai based API & Bulk Drug major is surging in business after it received mega orders from both india & abroad, it is also believed that the company will soon have new promoters & will concentrate more on branded formulations & food supplements with Eubage’s partnership. The deal with Ochoa Labs will give Dr. Datsons a new lease of export business besides other clients. Dr. Datson Labs is among the low prices shares that were actively traded. The share closed the day at Rs 17.59, up 0.83, or 4.95% with volumes of 464,110 shares against the previous day close of 16.76. It is expected to be in the range of 30 in coming days in view of the strong interest in this scrip.

Biotechnology : Biocon

Biocon, the Biotechnology firm, on Wednesday filed prospectus with market regulator Sebi for the initial public offer (IPO) of its research arm Syngene through which it aims to raise around Rs 600 crore that will be used to fund its R&D programmes. On Thursday, the shares closed 4.15 points or 0.91 per cent lower at Rs 451.95 per share.

Banking : YES Bank

YES Bank, India’s fifth largest private sector lender, announced on Wednesday that it will raise $1 billion by selling shares in local and overseas markets. Shares of the bank closed at Rs 851.40 per share, up by 6.99 per cent on Thursday.

Aviation : Jet Airways

Jet Airways announced on Wednesday that it will seek shareholders’ approval next month to raise up to $400 million (over Rs 2,500 crore) through issue of securities on private placement basis. Reacting to this, the shares of the carrier closed at Rs 412.60 apiece, down by 0.67 per cent.

Banking : HDFC Bank

HDFC Bank, India’s second-largest private sector lender, on Thursday reported 21 per cent rise in its net profit at Rs 2,806.91 crore for the fourth quarter ended March 2015. As a result of this, shares of the bank closed at Rs 1013.50 apiece, down by 0.14 per cent. On Thursday, the shares closed 4.15 points or 0.91 per cent lower at Rs 451.95 per share.