Indian Bill Payment Market To Cross over 10 trillion by 2020

India bills payment market has witnessed a growth in recent years on account of rising demand for online methods of bills payment fueled by introduction of new technologies, rising internet and smartphone penetration, geographical penetration and entry of new players. The growth in bills payment market has been largely led by the various factors such as rising contribution of utility sector, rising personal disposable incomes, rise in online shopping owing to lower prices relative to brick and mortar stores and presence of a large number of online retailers offering payment through debit/credit cards and net banking. India bills payment market transaction volume have grown at a Cagr of 15.5% From FY’2010-FY’2015. Mobile wallet transaction is among the fastest growing paperless modes, though settlements through this mode were valued at a miniscule INR 1,000 billion in FY’2015. About 50% of the transactions through wallets in FY15 were for remittances and shopping while the rest 50% for mobile bills payment, DTH bills payment, data card bills payment, bill payments and movie / travel ticket purchase

Disruptive Innovations on India’s Cashless Wallet : The New Sunrise Industry

Retail payments are in the midst of a big revolution. Unified Payments Interface (UPI), the advanced version of Immediate Payment Service (IMPS) — a round-the-clock funds transfer service — is set to make cashless payments faster and easier.Created by the National Payment Network Company (NPCI), set up with the support of the Reserve Bank of India and Indian Banks Association (IBA), UPI is a unique payment solution as the recipient is now empowered to initiate the payment request from a smartphone without using credit or debit card and internet banking. UPI is expected to give payment wallets like PayTM and Mobikwik a run for their money. While as many as 29 banks had concurred to provide UPI service to their customers, nearly 21 banks have gone already live with UPI.It facilitates a ‘virtual address’ as the payment identifier for sending and collecting money and works on a single click two-factor authentication. It also provides an option for scheduling push and pull transactions for various purposes like sharing bills among peers.

Customers can use UPI app instead of paying cash on delivery on receipt of product from online shopping websites. They can use UPI for expenses like paying utility bills, over the counter payments, barcode (scan and pay) based payments, donations, school fees and other such unique and innovative use cases. They just need to register with UPI service of a bank (Payment Service provider).UPI will offer a facility to identify a bank customer with an email-like virtual address. It will allow a customer to have multiple virtual addresses for multiple accounts in various banks. In order to ensure privacy of customer’s data, there is no account number mapper anywhere other than the customer’s own bank. This allows the customer to freely share the financial address with others. A customer can also decide to use the mobile number as the name.

How does it work?

When customer XYZ initiates e-commerce purchase of shirts online using only his virtual ID after selecting UPI as the payment mode, a pop-up/push notification is received on his Payment Service provider (PSP) app requesting for a confirmation of the payment. He simply enters his secure pin to authenticate the purchase transaction and within seconds receives a confirmation of a successful online purchase from the merchant. XYZ had created his virtual ID/ address as part of the registration process with the PSP.

XYZ reaches the payment section on the merchant site post adding goods to his shopping cart and selects UPI as the payment mode. He is only required to enter his virtual ID to proceed and nothing else. When the transaction request hit merchant’s server, it is immediately passed on to the acquiring bank’s server where a UPI Collect transaction is initiated on the virtual ID shared by XYZ from the merchant’s server.

This request is then routed to UPI server and using XYZ’s virtual ID the transaction request is directed towards his PSP app. A pop-up appears on the app screen requesting for the secured pin. He authenticates the transaction request and the transaction proceeds to the UPI system where the actual account details are fetched up against the mapped virtual ID.

This transaction is then pushed to XYZ’s bank account, where the credentials are validated and his account is debited. The confirmation is again pushed back to UPI servers and in turn it initiates a credit message to the merchant’s acquiring bank and the credit to the merchant happens in real time.

IN A NUTSHELL

- Register with a Payment Service provider (PSP)

- Single click 2-factor authentication for transactions

- Cash payment, use of debit, credit cards, internet banking etc. not

- involved

- ‘Virtual address’ as a payment identifier for sending to and collecting

- money from

- Best answer to cash on delivery hassle, running to nearest ATM or

- rendering exact amount

- Merchant payment with single app or In-App payments

- Schedule, PUSH and PULL payments for various purposes

- Utility bill payments, over the counter payments, barcode (scan and pay)

- based payments

On 29 February 2016, India’s finance ministry said in its office memorandum titled Promotion of Payments through Cards and Digital Means that the “Department of Financial Services/RBI shall relax Two Factor Authentication for both card present and card not present transactions below a certain specified amount. DFS/RBI shall work out a multi-tired authentication framework for low, medium and high value transactions.” This is a major policy development which, when coupled with the National Payment Corporation of India’s (NPCI) Unified Payment Interface (UPI) system —to be launched at the hands of the RBI Governor on 11 April 2016 —has the potential to revolutionize mobile payments in India.

- Authentication is about verifying that you are who you say you are. What is 2 factor authentication (2FA)? 2FA means using any two out of the following factors of authentication:

- Possession factor: what you have (example SIM card)

- Inheritance factor: what you are (example fingerprint)

- Knowledge factor: what you know (example passwords)

- Now, for most mobile phone customers in India, 2FA is either expensive or inconvenient or both. As perEricsson Mobility Report India June 2015 : Smartphones make up only 15% of the mobile phone subscriptions in 2014 and they project that by 2020, this number will reach 55%. Because of network effects, it will be more convenient for everyone that mobile payments work for both basic mobile phones as well as smartphones. A scenario in which a vegetable vendor can receive payments only from those with smartphones but where she cannot pay her vendor through a basic mobile handset cannot be considered as convenient.In the case of basic mobile phones, the deployment of apps is a major challenge. In Kenya, Safaricom does a SIM swap for an MPesa customer wherein the app is on the new SIM . This can be huge challenge for addressing hundreds of millions of customers in India with a multitude of telecom operators. In Tanzania, Vodacom uses Unstructured Supplementary Service Data (USSD) technology; however, USSD generally has poorer user interface and is generally not considered a success in India’s mobile payments space. (USSD is commonly used by prepaid GSM cellular phones to query the available balance.)2FA is difficult to achieve on a basic handset as the hardware does not support inheritance factor (example fingerprint authentication) and knowledge factor presents huge challenges when attempted on a scale of hundreds of millions, necessitating distribution of passwords through post/courier and password reset. Moreover, passwords slow down the user experience—especially when there is no access to mobile internet as is often the case with basic mobile handsets.Thus, a requirement of 2 factor authentication makes mobile payments either expensive or inconvenient or both expensive and inconvenient.Consider single factor authentication (1FA). Now, it is conceptually easy to undertake mobile number (MSISDN) authentication through a system (additional steps could be required for strengthening the mobile number authentication). Caller ID is the simplest manual way of doing just that; that is, possession factor authentication.Now, coupled with the soon to be rolled-out NPCI UPI system, it will be possible to make payments based on the payee’s mobile number and amount. That’s because a centralized map will map the payee’s mobile number to her bank account and then use existing NPCI’s products like IMPS to effect the payment. This will make mobile payment inter-operable without asking the payer for excess information. (More details are available here .)

- (Note: NPCI UPI can work with multi-factor authentication method too.)

- For mobile payments, we need to seek a suitable three-way compromise between security, convenience and cost. 1FA instead of 2FA in the case of small payments seems like a reasonable compromise in security for the sake of greater convenience. And one way to address the lower security in 1FA would be for the bank to buy fraud insurance cover to protect itself and its customer. This will undoubtedly raise the cost but as long as fraud analytics is used for early detection, the cost can be managed—as the insurer ought to charge a lower fraud insurance premium if the loss can be limited quickly. A fraud insurance cover will also address a significant reason for non-adoption of mobile payments by the customers. Without fraud insurance and early detection of fraud, the regulator may have valid concerns related to systemic risk due to small payments.A truly competitive mobile payments solution—at least in the case of small payments—ought not to have costs for customer. This is as there are neither explicit nor implicit costs in using currency notes for the purpose of small payments.In response to an RTI query, the RBI has said that it costs Rs 1.79 to produce a Rs 100 currency note . This cost is not borne by the user of the currency note. It is quite convenient to carry a Rs1,000 note or Rs500 note in the pocket. On the other hand, there are significant implicit costs in carrying large amounts in the form of currency notes. Additionally, there would be supply-chain related costs during the life of the currency note followed by end-of-life disposal related costs. There is a strong case for a transaction amount based multi-tiered tariff structure with zero tariff for small payments. Otherwise, mobile payments would primarily get limited to remittances.

- The 1FA for small payments combined with the soon-to-be launched uniform payments interface system presents a great opportunity for adoption of mobile payments beyond just remittance. It can make financial inclusion a reality by negating the need to convert to currency notes (through bank branches/ATMs/micro-ATMs)—something that could be considered as a wasteful exercise in the future. And the mobile payments’ digital trail can drive future innovations including the design of new financial products. Mobile payments can facilitate the delivery of these new as well as existing financial products. This, in turn, can power financial inclusion.

- What may still go wrong? Poor quality of service by the telecom networks can render policy changes and product innovations ineffective!

Payments revolution: After Aadhaar, NPCI showcases India’s tech talent

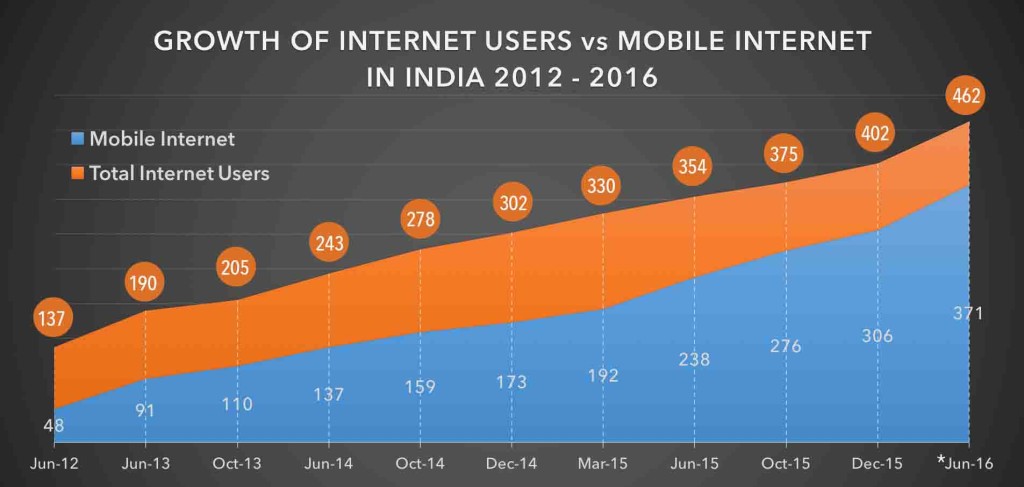

The spread of internet banking and, after that mobile wallets, has done wonders for India’s digital payments economy and the number is set to grow exponentially.

The spread of internet banking and, after that mobile wallets, has done wonders for India’s digital payments economy – according to the latest FIBAC report, though the value was far smaller, there were more transactions on non-bank digital wallets (255mn transactions) in FY15 than there were mobile banking transactions (172mn), and the number is set to grow exponentially. The problem is, much of this is not inter-operable, so what is being created was a series of silos – banks put restrictions on their customers loading cash on to other wallets, many taxi aggregators accept digital payments only through their wallets and transferring money from one wallet to another is next to impossible though the presence of platforms like Chillr does help to some extent. The fact that India has just 1.2 million point-of-sale (PoS) devices that can read debit/credit cards – in around 25 million or more merchant outlets – also puts a limit to the spread of cards. Also, using debit/credit cards exposes user to the risk of their cards being cloned and internet banking is time-consuming given how details of the user’s bank account and IFSC code need to be fed in – creating a beneficiary account for internet banking also takes a few hours, taking away the necessary flexibility so important in a digital age. Hardly surprising then, that the bulk of transactions in India tend to take place in cash.

Just as it changed the card business with its RuPay, the state-owned National Payments Corporation of India (NPCI) has come up with a revolutionary payments concept that is both interoperable and is fully mobile – with this, NPCI joins an illustrious list of state-promoted initiatives like NSE, NSDL and UIDAI that both revolutionized their businesses and showcased India’s tech talent and ability to come up with easy solutions to truly large problems. Unlike the existing systems that are time-consuming and require users to input lots of details (like the IFSC code of the beneficiary or your credit card number, expiry date and CVV), NPCI’s United Payments Interface allots each user a unique number – financialexpress@sbi, for instance – which is linked to his/her bank account. A user may or may not wish to link an Aadhaar number to a UPI address and can even create different UPI addresses for different people – one for the kirana shop and another for buying on Amazon. If a payment has to be made, it can be made to this ID without any personal information being shared, making the system a lot safer than others. With most banks expected to be on UPI quite soon, digital transactions get a huge leg up since the system is bank agnostic. Also, since any individual with a bank account and a phone – right now, UPI cannot be used by wallets – can receive money, the restriction put by having just 1.2mn PoS devices goes away. UPI also allows a seller, for instance, to raise a bill on someone and if the person okays the transaction – by inputting a PIN number – the payment gets made. This is just the beginning since, as happened with Aadhaar, you can expect to see a host of apps getting built using UPI. Truly, a great day in India’s payments history.

In mid 2015, the Reserve Bank of India announced its approval to allow 11 entities – notably Aditya Birla Nuvo Limited, Reliance Industries Limited and Tech Mahindra Limited – to set up payments banks. Payments banks signal a new revolution in the country’s banking sector, and have been heralded by Finance Minister Arun Jaitley. Which brings us to the important question : what exactly is a payments bank and why is it being considered as revolutionary?

How a payments bank operates

The textbook definition of a payments bank is that it is a differentiated bank concerned only with specific restricted functions allowed by the Banking Regulation Act of 1949. The activities include deposits, payments and remittance; internet banking; and functioning as a business correspondent of other banks.

- The RBI is clear on what a payments bank can and cannot do.

- It can accept deposits of not more than Rs. 1 lakh per customer and pay interest on the deposited money.

- Only the money customers deposit into government securities is allowed to be invested.

- It can be used for savings or current account.

- It can issue ATM/debit cards but not credit cards.

- It can facilitate money transfers.

- It can sell mutual funds and insurance.

- It cannot loan money.

- It cannot establish subsidiaries to carry out non-banking financial services.

The implications of payments banks for companies operating as mobile wallets is clear. They can now raise the funds limit and receive interest on deposits, which is bound to invite more users to store their money securely and conveniently with Paytm, Oxigen Wallet, m-Pesa, MobiKwik, PayUMoney and the like. Also, the ability to issue debit and ATM cards will make virtual money-cash conversions easier for license holders.

- What kind of needs have led to the concept and development of payments banks?

- The following requirements and situations are the driving force behind the establishment of payments banks.

- Financial inclusion

The main reason for payments banks being considered a revolution is that they are expected to bring the unbanked population (adults without their own bank accounts) within the scope of formal banking, thereby facilitating financial inclusion. They will make banking more accessible to people in rural areas and poorly connected terrains. For instance, if you deposit cash into an m-Commerce bank account from your city, then your aged parents in the village can withdraw cash from any ATM as long as they have the debit card, or even receive the cash from a POS terminal via the bank’s authorized partner. The government expects payments banks to make the economically-backward classes more financially literate and assist them in combating poverty.

Addresses bank account dormancy

Around 20 crore bank accounts in India are lying dormant. Payments banks can serve at least as transactional instruments if not a savings instrument. There’s a financial inclusion elements here as well, as payments banks can now make payments/remittance more accessible and seamless for small businesses and migrant labor workforce.

- Benefits to banks

- Payments banks will be advantageous to banks in many ways :

- They will help the greater flow of money into the banking system.

- Banks that have been looking to increase their rural reach will be better poised to do so.

A MasterCard study reveals that the costs of maintaining, managing and transporting cash add up to thousands of crores each year for the banking sector. Electronic transactions and mobile banking will help in reducing this cost significantly.

Payments bank license will also allow the network of over 1.5 lakh post offices to offer banking services to the country’s masses.

The mobile payment revolution has begun

- Mobile payments emerged in answer to consumers’ evolving expectations around convenience and value. With the acceptance of online and mobile banking, it was only a matter of time before consumers started expecting their banks to provide mobile payment solutions. There is a need to address this expectation due to the following reasons:

- Banks cannot afford to wait for others to develop their payment solutions, or they may find themselves excluded from the conversation between their customers and the payment solution provider. The issue here is that customer relationships and brand engagement can shift from the bank itself to the entity who is providing its digital wallet.

- Mobile payments will help banks seeking to create multichannel relationships with customers. With mobile shopping on the rise, it is not uncommon for consumers to have one or more payment apps on their phones. Banks should seize this opportunity to ensure that they are the ones providing one of these apps.

- Mobile wallet providers can gain access and derive insights into paying behaviors, including the type of transactions and the items bought. For banks, this customer data is no doubt valuable in helping improve products/services.

In our experience, we have seen that unbanked individuals embrace mobile phone banking really well, conducting all transactions through them. Mobile banking and payments also have a unique appeal for Millenials who spend a lot of time on their smartphones.